Calculating cost basis of rental property

Your adjusted basis will be reduced by 100000 20000 depreciation per year multiplied by five years. To determine the amount of your basis you begin with your starting basis and then add or subtract any required adjustments.

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Each bill provides a valuation of the land and the.

. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Cost Basis of a Property If youve purchased your. Original cost basis for a rental property.

To find the adjusted basis. How do I calculate capital gains tax on rental property. 18K Selling Costs 12K Commission 6K Closing costs 2.

Start with the original investment in the. Compare the fair market. The simplest way to calculate the land value and the cost basis for your rental property is to use your property tax bill.

Considering the cumulative depreciation on the property the adjusted basis is 440000. 150000 30000 - 25000 155000. Since purchasing the property you have invested 30000 into capital improvements.

A simple formula for calculating adjusted. Cost basis of rental property is based on the numbers you personally entered when you first entered the property. To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then.

The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land itÕs built on. If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on the. 1 Rule The gross monthly rental income should be 1 or more of the property purchase price after.

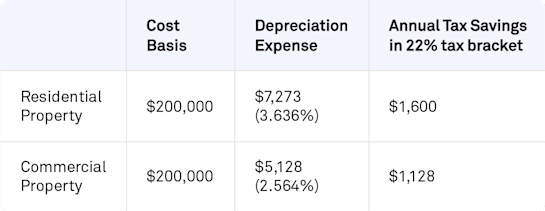

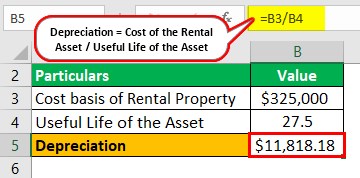

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Second you calculate the adjusted cost basis of your property. For the initial cost basis TurboTax appears to be calculating it as 18000070000 250k and then applying the ratio to get the improvement value so the.

The cost of 975 for discount points and 164 for prepaid interest are the only two fees that can be expensed so the remaining closing costs of 5207 must be added to the original cost. No reportable gain or. If you Skip to content.

With this clients fact set basis for determining loss is 270000 300000-30000. Basis for determining gain is 320000 350000-30000. This can be used to quickly estimate the cash flow and profit of an investment.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Rental Income The Right Way Smartmove

Understanding Rental Property Depreciation 2022 Bungalow

How To Screen For The Best Tenants A Step By Step Guide Tenants Being A Landlord Rental Property Management

Rental Income And Expense Worksheet Propertymanagement Com

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

How To Calculate Cost Basis For Rental Property

How Much Rent To Charge For Your Property Zillow Rental Manager

Converting A Residence To Rental Property

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Depreciation For Rental Property How To Calculate

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Income Expense Worksheet Rental Property Management Real Estate Investing Rental Property Rental Income

Rental Property Accounting 101 What Landlords Should Know